Master Sales Tax Calculator: Complete Guide

The Ultimate Sales Tax Calculator Guide: Master Tax Calculations, Exemptions, and Compliance

Every day, millions of Americans overpay on sales tax or struggle with complex calculations that cost their businesses valuable time and money. Whether you're a consumer trying to understand your receipt total or a business owner navigating multi-state tax obligations, mastering the sales tax calculator is your essential tool for financial accuracy and peace of mind.

In this comprehensive guide, we'll demystify every aspect of sales tax calculation, from basic formulas to industry-specific considerations, and provide you with expert strategies to ensure compliance while maximizing your tax efficiency. You'll discover not just how to calculate sales tax, but how to leverage this knowledge to make smarter financial decisions for your personal life or business operations.

1. Understanding Sales Tax Fundamentals

Sales tax represents a consumption tax imposed by government authorities on the sale of goods and services. Typically calculated as a percentage of the purchase price, this tax generates significant revenue for state and local governments, funding everything from infrastructure to education.

The concept of sales tax emerged in the United States during the Great Depression when West Virginia became the first state to implement a general sales tax in 1921. By the end of the 1930s, 30 states had adopted some form of sales tax as a way to generate revenue without burdening property owners. Today, 45 states and the District of Columbia collect statewide sales taxes, with rates ranging from 2.9% in Colorado to 7.25% in California.

Unlike income tax, which is based on earnings, or property tax, based on asset value, sales tax is a transaction-based tax. This means it only applies when specific economic activities occur—namely, the exchange of goods or services for consideration. The responsibility for collecting and remitting sales tax typically falls on businesses selling taxable products or services, while the economic burden ultimately falls on the end consumer.

The economic impact of sales tax cannot be overstated. According to the Tax Foundation, state and local governments collected over $500 billion in sales tax revenue in 2022, accounting for approximately 30% of all state tax collections and 12% of local tax collections. This revenue stream provides essential funding for public services while being generally considered more stable than income tax during economic downturns.

Who Actually Pays Sales Tax?

While businesses collect sales tax, the legal incidence (who bears the legal responsibility for payment) varies by state. In most states, the seller has the legal obligation to collect and remit sales tax, while the economic incidence (who actually bears the financial burden) falls on the consumer. This distinction becomes crucial in understanding why compliance is so important for businesses.

For consumers, sales tax is typically unavoidable on most purchases, though strategic shopping can minimize its impact. For businesses, proper sales tax collection and remittance is a legal requirement with significant penalties for non-compliance, including fines, interest, and in extreme cases, criminal charges.

2. Types of Sales Tax Systems

Origin-Based vs. Destination-Based Sourcing

The United States employs two primary systems for determining which jurisdiction's sales tax rate applies to a transaction: origin-based and destination-based sourcing.

In origin-based sourcing, the sales tax rate is determined by the seller's location. This means that regardless of where the buyer is located, the tax rate applied is the rate at the seller's place of business. Currently, ten states follow this system: Arizona, California, Illinois, Mississippi, Missouri, New Mexico, Ohio, Pennsylvania, Tennessee, and Texas. For businesses operating in these states, tax collection is relatively straightforward, as they only need to track and apply their local tax rate.

Destination-based sourcing, used by the remaining 35 states with sales tax, applies the tax rate of the buyer's location. This system becomes significantly more complex for businesses, especially those selling across multiple jurisdictions, as they must determine the correct tax rate for each customer's location. For example, a business based in Chicago selling to customers throughout Illinois would need to apply different tax rates depending on whether the customer is in Chicago (with its local taxes) or in another part of the state.

The Supreme Court's 2018 decision in South Dakota v. Wayfair fundamentally changed the landscape for destination-based sourcing by allowing states to require remote sellers to collect sales tax even without a physical presence in the state. This ruling, based on the concept of economic nexus, means businesses must now navigate complex multi-state tax obligations based on their sales volume into each state.

State Sales Tax Structures

States employ various structures for their sales tax systems, with significant differences in what's taxable and what's exempt. Some key structural variations include:

Single-rate states: Five states (Indiana, Massachusetts, Michigan, New Jersey, and Rhode Island) have a single state-level sales tax rate with no local sales taxes. This simplifies compliance for businesses operating in these states.

Local option states: Most states allow local jurisdictions (counties, cities, special districts) to impose additional sales taxes on top of the state rate. These local rates can vary significantly, creating complex tax landscapes. For example, in Colorado, combined state and local rates range from 2.9% (state only) to over 11% in some tourist areas.

Tax base differences: States vary dramatically in what they subject to sales tax. Some states tax most goods and few services, while others have broad tax bases that include many services. For instance, New Hampshire has no sales tax on most goods but taxes meals and lodging, while Hawaii taxes nearly all business transactions, including many services that are exempt in other states.

Local Sales Tax Variations

Local sales taxes add another layer of complexity to the sales tax landscape. These taxes, imposed by counties, cities, and special districts, can significantly increase the total tax rate consumers pay. For example:

In Alabama, the state sales tax rate is 4%, but local jurisdictions can add up to 7.5%, resulting in combined rates as high as 11.5% in some areas.

In New York, the state rate is 4%, but local rates range from 3% to 4.875%, with New York City adding its own 4.5% tax, resulting in a combined rate of 8.875%.

Colorado has one of the most complex local tax systems, with home rule jurisdictions that can set their own tax rules and rates, creating hundreds of different tax scenarios throughout the state.

These local variations make accurate sales tax calculation particularly challenging for businesses, especially those operating in multiple jurisdictions or selling online to customers across the country.

Special Sales Tax Districts

Beyond standard state and local sales taxes, many areas have special tax districts that impose additional sales taxes for specific purposes. These can include:

Transportation districts: Funding public transit and infrastructure improvements Stadium districts: Financing sports facilities Tourism districts: Supporting tourism promotion and facilities Public safety districts: Funding police and fire services

For example, in Missouri, the St. Louis Metropolitan District imposes an additional 1% sales tax to fund public transportation, while in Minnesota, the Target Field stadium in Minneapolis has a special 0.15% sales tax to help fund the facility.

These special district taxes further complicate sales tax calculations, as they often apply only within specific geographic boundaries and may have different rules from standard sales taxes.

Sales Tax Holidays and Temporary Exemptions

Many states offer sales tax holidays—temporary periods when certain items can be purchased without sales tax. These holidays typically occur before the back-to-school season and often apply to items like:

Clothing and footwear under a specified price threshold School supplies Computers and computer accessories Energy-efficient appliances

For example, Texas holds an annual sales tax holiday in August for clothing, footwear, school supplies, and backpacks priced under $100, saving consumers approximately 8.25% on qualifying items.

Some states also offer temporary exemptions for specific purposes, such as disaster preparedness (tax-free on emergency supplies) or energy conservation (tax-free on efficient appliances). These temporary exemptions create additional complexity for retailers, who must adjust their systems to accommodate the changing tax rules.

3. Sales Tax Rates Across the United States

Comprehensive State-by-State Rate Guide

Sales tax rates vary dramatically across the United States, creating a complex patchwork that challenges businesses and confuses consumers. Here's a comprehensive look at current state sales tax rates as of 2023:

States with No Statewide Sales Tax:

- Delaware

- Montana

- New Hampshire

- Oregon

States with Low Sales Tax Rates (Under 5%):

- Colorado: 2.9%

- Georgia: 4%

- Hawaii: 4%

- New York: 4%

- Wyoming: 4%

- Alabama: 4%

- Louisiana: 4.45%

- Oklahoma: 4.5%

- South Dakota: 4.5%

- Wisconsin: 5%

States with Moderate Sales Tax Rates (5%-7%):

- Idaho: 6%

- Kansas: 6.5%

- Massachusetts: 6.25%

- Rhode Island: 7%

- Utah: 6.1%

- Virginia: 5.3%

- West Virginia: 6%

- Arkansas: 6.5%

- Connecticut: 6.35%

- Florida: 6%

- Illinois: 6.25%

- Iowa: 6%

- Kentucky: 6%

- Maryland: 6%

- Michigan: 6%

- Nebraska: 5.5%

- North Carolina: 4.75%

- North Dakota: 5%

- Pennsylvania: 6%

- South Carolina: 6%

- Vermont: 6%

- Washington: 6.5%

States with High Sales Tax Rates (Above 7%):

- Arizona: 5.6%

- California: 7.25%

- Indiana: 7%

- Minnesota: 6.875%

- Mississippi: 7%

- Missouri: 4.225%

- Nevada: 6.85%

- New Jersey: 6.625%

- New Mexico: 5.125%

- Ohio: 5.75%

- Tennessee: 7%

- Texas: 6.25%

Note: These rates represent state-level sales tax only and do not include local taxes, which can significantly increase the total rate.

Interactive Map Visualization Concept

An ideal sales tax calculator resource would include an interactive map of the United States showing both state and local sales tax rates. This visualization would allow users to:

- Hover over states to see the state-level rate

- Click on states to drill down to county and city rates

- Search for specific addresses to get precise tax rates

- Compare rates between different locations

- View historical rate changes over time

Such a tool would be invaluable for businesses operating in multiple jurisdictions and for consumers planning significant purchases.

Highest and Lowest Sales Tax States

When considering combined state and local sales tax rates, the landscape changes significantly. According to the Tax Foundation's 2023 analysis, the states with the highest combined average sales tax rates are:

- Tennessee: 9.548%

- Louisiana: 9.547%

- Arkansas: 9.448%

- Washington: 9.386%

- Alabama: 9.24%

The states with the lowest combined average sales tax rates are:

- Alaska: 1.76% (no state sales tax, only local)

- Hawaii: 4.44%

- Wyoming: 4.45%

- Wisconsin: 5.43%

- Maine: 5.5%

It's worth noting that five states have no statewide sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. However, Alaska allows local jurisdictions to impose sales taxes, resulting in the low average rate mentioned above.

Average Combined Rates by Region

Sales tax rates also show regional patterns across the United States:

Northeast:

- Average combined rate: 6.48%

- Range: No sales tax (Delaware) to 8.98% (Rhode Island)

- Characteristics: Generally moderate rates with fewer local variations

Southeast:

- Average combined rate: 7.12%

- Range: 4% (Virginia) to 9.55% (Tennessee)

- Characteristics: Higher rates with significant local variations

Midwest:

- Average combined rate: 6.85%

- Range: No sales tax (Montana) to 8.72% (Illinois)

- Characteristics: Moderate rates with some local variations

Southwest:

- Average combined rate: 7.61%

- Range: 5.49% (Oklahoma) to 8.4% (Arizona)

- Characteristics: Higher rates with significant local variations

West:

- Average combined rate: 6.88%

- Range: No sales tax (Oregon) to 9.39% (Washington)

- Characteristics: Wide variation, including states with no sales tax

Recent Changes in State Sales Tax Rates

Sales tax rates are not static; they change regularly as states and localities adjust their tax policies. Some notable recent changes include:

- Illinois increased its state sales tax rate from 6.25% to 6.875% in 2020 to fund infrastructure improvements.

- Iowa reduced its state sales tax rate from 6% to 5.5% in 2023 as part of a broader tax reform package.

- Several localities in California have increased their sales tax rates to fund transportation and infrastructure projects, pushing some combined rates above 10%.

- Colorado has seen numerous local tax changes as home rule jurisdictions continue to adjust their rates and rules.

Businesses must stay current with these changes to maintain compliance, highlighting the importance of using an updated sales tax calculator or automated tax solution.

4. How to Calculate Sales Tax: Step-by-Step Guide

Basic Sales Tax Calculation Formula

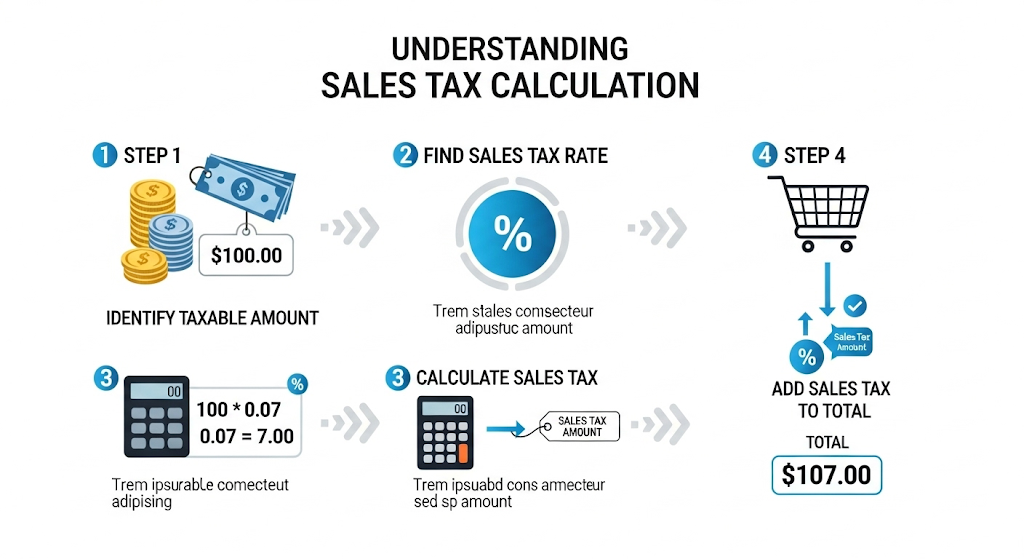

The fundamental formula for calculating sales tax is straightforward:

Sales Tax Amount = Purchase Price × Sales Tax Rate

For example, if you purchase a $100 item in a location with a 7% sales tax rate: Sales Tax Amount = $100 × 0.07 = $7

The total cost would be: Total Cost = Purchase Price + Sales Tax Amount = $100 + $7 = $107

While this basic formula is simple, real-world applications often involve additional complexity, including multiple tax rates, exemptions, and special rules.

Calculating Sales Tax on Single Items

For single items, the calculation follows the basic formula, but you must first determine the correct tax rate. This involves:

- Identifying the location where the sale takes place (for origin-based states) or where the product will be used (for destination-based states)

- Determining the applicable state, county, city, and special district tax rates

- Adding these rates together to get the total tax rate

- Applying this rate to the purchase price

Example: Calculating sales tax on a $500 television purchased in Chicago, Illinois:

- Illinois state rate: 6.25%

- Cook County rate: 1.75%

- Chicago rate: 1.25%

- Total rate: 9.25%

- Sales tax amount: $500 × 0.0925 = $46.25

- Total cost: $500 + $46.25 = $546.25

Calculating Sales Tax on Multiple Items

When calculating sales tax on multiple items, you must consider whether different items have different tax rates. Some jurisdictions tax different product categories at different rates.

For items with the same tax rate:

- Sum the prices of all items

- Apply the tax rate to the total

Example: Purchasing three items ($30, $50, and $70) in a location with an 8% tax rate:

- Total purchase price: $30 + $50 + $70 = $150

- Sales tax amount: $150 × 0.08 = $12

- Total cost: $150 + $12 = $162

For items with different tax rates:

- Group items by tax rate

- Calculate the subtotal for each group

- Apply the appropriate tax rate to each subtotal

- Sum the subtotals and tax amounts

Example: Purchasing groceries ($50, tax-exempt), clothing ($100, taxed at 5%), and electronics ($200, taxed at 8%):

- Groceries subtotal: $50 × 0% = $0 tax

- Clothing subtotal: $100 × 5% = $5 tax

- Electronics subtotal: $200 × 8% = $16 tax

- Total purchase price: $50 + $100 + $200 = $350

- Total sales tax: $0 + $5 + $16 = $21

- Total cost: $350 + $21 = $371

Working Backwards from Total to Find Pre-Tax Amount

Sometimes you need to calculate the pre-tax amount when you only know the total amount paid and the tax rate. This is common when reviewing receipts or budgeting for purchases.

The formula for this calculation is: Pre-Tax Amount = Total Amount ÷ (1 + Tax Rate)

Example: If you paid $107 for an item in a location with a 7% sales tax: Pre-Tax Amount = $107 ÷ (1 + 0.07) = $107 ÷ 1.07 = $100

This calculation confirms that the original price was $100, with $7 in sales tax.

Handling Rounding in Sales Tax Calculations

Sales tax calculations often involve rounding, as tax amounts typically must be rounded to the nearest cent. Different jurisdictions have specific rules for rounding:

- Round up: Always round up to the next cent

- Round down: Always round down to the previous cent

- Round to nearest: Round to the nearest cent (up for 0.5 cents and above, down for less than 0.5 cents)

Most jurisdictions follow the "round to nearest" approach, but businesses must verify the specific rules in each location where they collect sales tax.

Example: Calculating sales tax on $1.99 with a 7.25% tax rate:

- Tax amount: $1.99 × 0.0725 = $0.144275

- Rounded to nearest cent: $0.14

- Total cost: $1.99 + $0.14 = $2.13

For businesses processing high volumes of transactions, these rounding differences can add up, making accurate calculation systems essential.

5. Sales Tax Exemptions and Special Cases

Common Exempt Items and Services

While sales tax generally applies to most retail sales, every state provides exemptions for certain items and services. Understanding these exemptions is crucial for both businesses and consumers to ensure accurate tax collection and maximize savings.

Food and Groceries: Many states exempt or reduce the tax rate on food and groceries. For example:

- California exempts most food products for human consumption

- Illinois taxes groceries at a reduced rate of 1%

- Pennsylvania exempts most food items but taxes prepared foods

Prescription Drugs: All states exempt prescription medications from sales tax. This exemption typically includes:

- Prescription drugs

- Insulin

- Medical devices prescribed by a physician

- Over-the-counter medicines when prescribed

Clothing and Footwear: Several states provide exemptions for clothing and footwear, often with price thresholds:

- Massachusetts exempts clothing items under $175

- Minnesota exempts all clothing and footwear

- New York exempts clothing and footwear under $110

- Pennsylvania exempts most clothing

Manufacturing and Agriculture: States commonly exempt purchases related to manufacturing and agriculture:

- Raw materials

- Machinery and equipment used in production

- Utilities used in production

- Packaging materials

Non-Profit Organizations: Qualified non-profit organizations often receive exemptions on purchases related to their exempt purposes:

- Religious organizations

- Educational institutions

- Charitable organizations

- Government entities

Industry-Specific Exemptions

Different industries have specific exemption rules that reflect their unique operational needs:

Construction Industry:

- Materials that become part of real property

- Equipment used directly in construction

- Safety equipment required by regulation

Healthcare Industry:

- Medical equipment and supplies

- Prosthetic devices

- Wheelchairs and mobility aids

- Hospital supplies

Manufacturing Industry:

- Raw materials

- Machinery and equipment

- Utilities used in production

- Packaging materials

Agriculture Industry:

- Farm equipment

- Seeds and plants

- Fertilizers and pesticides

- Feed for livestock

Technology Industry:

- Data center equipment

- Software development tools

- Research and development equipment

Resale Certificates and Exemption Certificates

Businesses that purchase items for resale can avoid paying sales tax on those purchases by providing a resale certificate to the supplier. This document certifies that the purchaser intends to resell the items and will collect sales tax from the final customer.

Key aspects of resale certificates include:

Requirements for Valid Certificates:

- Must be in writing (electronic or physical)

- Must include the buyer's name and address

- Must include the buyer's tax ID number

- Must include a description of the items being purchased

- Must state that the items are for resale

Responsibilities of Buyers:

- Only use certificates for legitimate resale purchases

- Keep records of all certificates provided

- Renew certificates as required (some states require annual renewal)

- Collect sales tax when items are sold to end consumers

Responsibilities of Sellers:

- Verify the validity of certificates

- Keep copies of certificates on file

- Ensure certificates are properly completed

- Refuse to accept certificates that appear invalid

Penalties for Misuse: Both buyers and sellers can face significant penalties for improperly using or accepting resale certificates:

- Fines and penalties

- Interest on unpaid taxes

- Loss of business license

- Criminal charges in cases of fraud

Tax-Exempt Organizations

Qualified tax-exempt organizations can make purchases without paying sales tax by providing exemption certificates to sellers. These organizations include:

Types of Exempt Organizations:

- Religious organizations

- Educational institutions

- Charitable organizations

- Government entities

- Non-profit hospitals

Requirements for Exemption:

- Must have 501(c)(3) status from the IRS

- Must be registered with the state tax authority

- Must provide a valid exemption certificate

- Purchases must be related to the organization's exempt purpose

Limitations on Exemptions:

- Purchases for unrelated business activities are typically taxable

- Some states require annual renewal of exemption certificates

- Certain items may be excluded from exemption regardless of the purchaser's status

How to Apply for Exemptions

For businesses and organizations seeking sales tax exemptions, the application process varies by state but generally follows these steps:

For Resale Certificates:

- Register for a sales tax permit with the state

- Obtain the official resale certificate form from the state tax authority

- Complete the form with business information

- Provide the certificate to suppliers when making tax-exempt purchases

- Maintain records of all certificates used

For Organization Exemptions:

- Obtain 501(c)(3) status from the IRS

- Register with the state tax authority as a tax-exempt organization

- Complete the state's exemption certificate application

- Submit required documentation (articles of incorporation, bylaws, etc.)

- Await approval and receive exemption certificate

- Provide certificate to suppliers when making tax-exempt purchases

For Specific Item Exemptions:

- Determine if the item qualifies for exemption

- Complete the appropriate exemption certificate form

- Provide the certificate to the seller at the time of purchase

- Maintain records of exempt purchases

6. Sales Tax for Businesses

Understanding Nexus and Its Implications

Nexus is the legal term for a business connection or presence in a state that requires the business to collect and remit sales tax in that state. Understanding nexus is critical for businesses to determine their sales tax obligations.

Types of Nexus:

Physical Nexus:

- Brick-and-mortar locations

- Employees or representatives working in the state

- Inventory stored in the state

- Attending trade shows or events in the state

- Owning or leasing property in the state

Economic Nexus:

- Sales revenue thresholds (typically $100,000 or more in sales into the state)

- Transaction thresholds (typically 200 or more transactions into the state)

- Established by the South Dakota v. Wayfair Supreme Court decision

Click-Through Nexus:

- Relationships with in-state affiliates who refer customers

- Commission payments to these affiliates

- Established by "Amazon laws" in various states

Affiliate Nexus:

- Control over an in-state entity

- Shared branding or operations

- Common ownership or management

Determining Your Nexus Status: Businesses must evaluate their activities in each state to determine if they have established nexus. This involves:

- Reviewing physical presence in each state

- Analyzing sales volume and transaction counts into each state

- Examining relationships with in-state businesses

- Assessing marketing activities targeting each state

- Consulting with tax professionals for complex situations

Implications of Establishing Nexus: Once nexus is established in a state, businesses must:

- Register for a sales tax permit in that state

- Collect sales tax on taxable sales into that state

- File regular sales tax returns

- Remit collected taxes to the state

- Maintain records of sales and tax collected

Registering for Sales Tax Permits

Before collecting sales tax in any state, businesses must register for a sales tax permit. This process varies by state but generally follows these steps:

Determine Where You Need to Register: Based on your nexus analysis, identify all states where you have sales tax obligations.

Gather Required Information:

- Business name and structure

- Federal Employer Identification Number (FEIN)

- Business address and contact information

- Names of owners or officers

- North American Industry Classification System (NAICS) code

- Bank account information for electronic payments

Complete the Registration Application: Most states offer online registration systems, though some still require paper applications. The registration process typically includes:

- Creating an account with the state tax authority

- Completing the business registration form

- Providing details about your business activities

- Estimating your monthly sales tax liability

- Submitting the application and any required fees

Receive Your Sales Tax Permit: Once approved, you'll receive:

- A sales tax permit number

- Information about filing frequencies

- Instructions for filing returns

- Information about electronic filing requirements

- Tax rate tables and resources

Display Your Permit (If Required): Some states require businesses to display their sales tax permit prominently at their place of business. Check the specific requirements for each state where you're registered.

Collecting and Reporting Sales Tax

Once registered for sales tax permits, businesses must implement systems to collect and report sales tax accurately.

Implementing Sales Tax Collection:

- Configure point-of-sale systems with correct tax rates

- Train staff on taxable vs. non-taxable items

- Establish procedures for handling exemption certificates

- Create processes for online sales tax collection

- Implement systems for tracking sales by jurisdiction

Determining Taxability: Businesses must determine which items and services are taxable in each jurisdiction:

- Review state tax laws and regulations

- Consult taxability matrices or databases

- Implement systems to track product taxability

- Establish procedures for handling special cases

- Document taxability decisions for audit purposes

Calculating Sales Tax: Accurate calculation requires:

- Identifying the correct tax rate for each transaction

- Applying the appropriate rate based on product type

- Handling rounding according to state rules

- Calculating tax on bundled products and services

- Applying exemptions when valid certificates are provided

Maintaining Records: Proper record-keeping is essential for compliance and audit defense:

- Keep detailed sales records for at least 4 years

- Maintain exemption certificates on file

- Document taxability decisions

- Keep copies of all sales tax returns filed

- Retain records of tax payments made

Filing Sales Tax Returns: Businesses must file regular sales tax returns in each state where they're registered:

- Determine filing frequency (monthly, quarterly, annually)

- Gather sales data for the reporting period

- Calculate total sales and taxable sales

- Compute sales tax collected

- Complete and file the return by the deadline

- Remit payment for any tax due

Sales Tax Compliance Requirements

Maintaining sales tax compliance involves numerous ongoing requirements that businesses must fulfill.

Filing Frequencies: States assign filing frequencies based on sales volume:

- Monthly: Typically for businesses with high sales tax liability

- Quarterly: For businesses with moderate liability

- Annually: For businesses with low liability

Due Dates: Sales tax returns are typically due:

- Monthly filers: 20th-25th of the following month

- Quarterly filers: Last day of the month following the quarter

- Annual filers: January 31st of the following year

Electronic Filing Requirements: Many states mandate electronic filing for certain businesses:

- Businesses above a certain size or sales volume

- Businesses with multiple locations

- Businesses with complex filing requirements

Tax Rate Changes: Businesses must stay current with changing tax rates:

- Monitor state and local tax rate changes

- Update point-of-sale systems promptly

- Apply new rates effective on the implementation date

- Document rate changes for audit purposes

Taxability Rule Changes: States frequently update what's taxable and what's exempt:

- Subscribe to state tax authority notifications

- Review legislative changes affecting taxability

- Update product taxability codes

- Train staff on new requirements

Audit Triggers: Certain activities may increase audit risk:

- Frequent late filings

- Large refund claims

- Inconsistent reporting

- High exemption usage

- Significant changes in reporting patterns

Penalties for Non-Compliance

Failure to comply with sales tax requirements can result in significant penalties:

Late Filing Penalties:

- Typically 5-25% of the tax due

- May increase with additional months of delinquency

- Often assessed even if no tax is due

Late Payment Penalties:

- Usually 5-25% of the unpaid tax

- May include interest charges

- Can compound over time

Failure to File Penalties:

- Often higher than late filing penalties

- May be assessed as a flat fee or percentage

- Can apply even if no tax was due

Failure to Collect Penalties:

- Based on the tax that should have been collected

- May include interest and additional penalties

- Can be assessed for multiple periods

Fraud Penalties:

- Significant fines (often 50-100% of the tax due)

- Potential criminal charges

- Possible imprisonment for severe cases

- Revocation of business licenses

Negligence Penalties:

- Assessed for careless errors or omissions

- Typically 10-25% of the underpayment

- May be waived for reasonable cause

Interest Charges:

- Accrued on unpaid taxes and penalties

- Rates vary by state but typically 4-12% annually

- Compounded in some states

Personal Liability: In some cases, business owners or officers may be held personally liable for unpaid sales taxes, including:

- Trust fund taxes (tax collected from customers)

- Penalties assessed for fraud or willful non-compliance

- Taxes due when the business cannot pay

7. Sales Tax for E-commerce and Remote Sales

Economic Nexus After South Dakota v. Wayfair

The 2018 Supreme Court decision in South Dakota v. Wayfair fundamentally changed sales tax requirements for remote sellers. Prior to this decision, businesses needed a physical presence in a state to establish nexus and be required to collect sales tax. The Wayfair decision established that economic nexus alone could create a sales tax collection obligation.

Key Elements of the Wayfair Decision:

- States can require remote sellers to collect sales tax based on economic activity

- Physical presence is no longer the sole determinant of nexus

- States must establish reasonable thresholds for economic nexus

- Small sellers are protected from undue burden

Common Economic Nexus Thresholds: Following the Wayfair decision, most states established economic nexus thresholds based on:

- Sales revenue: Typically $100,000 in sales into the state

- Transaction volume: Typically 200 transactions into the state

- Or both: Meeting either the sales or transaction threshold

State Variations in Economic Nexus Laws: While most states adopted similar thresholds, some variations exist:

- California: $500,000 in sales

- New York: $500,000 in sales and 100 transactions

- Texas: $500,000 in sales

- Some states have lower thresholds for marketplace facilitators

Effective Dates: Economic nexus laws became effective at different times in different states:

- Some states had laws ready to implement immediately after the decision

- Others enacted new legislation with specific effective dates

- A few states still have not implemented economic nexus standards

Impact on Businesses: The Wayfair decision significantly affected businesses:

- Small businesses selling nationwide suddenly faced multi-state compliance burdens

- Many businesses had to register in numerous states

- Sales tax compliance costs increased substantially

- Demand for sales tax automation solutions grew dramatically

Marketplace Facilitator Laws

In response to the Wayfair decision, many states enacted marketplace facilitator laws, which shift the sales tax collection responsibility from third-party sellers to the marketplace platforms.

What Is a Marketplace Facilitator? A marketplace facilitator is a business that:

- Operates a marketplace for third-party sellers

- Facilitates sales between buyers and sellers

- May handle payment processing

- Often sets terms of the transaction

Common Marketplace Facilitators:

- Amazon

- eBay

- Etsy

- Walmart Marketplace

- Target+

- Shopify (for certain transactions)

Responsibilities of Marketplace Facilitators: Under marketplace facilitator laws, these platforms must:

- Determine taxability of items sold

- Calculate sales tax based on buyer location

- Collect tax from buyers at checkout

- Remit tax to appropriate states

- Provide tax reporting to sellers

Impact on Third-Party Sellers: Marketplace facilitator laws generally relieve sellers of collection responsibility when:

- Sales are made through a registered marketplace

- The marketplace assumes collection responsibility

- The seller has no other nexus in the state

State Variations: While most states have enacted marketplace facilitator laws, some differences exist:

- Definition of what constitutes a marketplace facilitator

- Thresholds for when facilitator laws apply

- Reporting requirements for facilitators and sellers

- Enforcement mechanisms

Handling Sales Tax for Online Sales

Online sales present unique challenges for sales tax collection and compliance.

Determining Tax Rates for Online Sales: For online sellers, determining the correct tax rate requires:

- Identifying the ship-to location (for destination-based states)

- Looking up state, county, city, and special district rates

- Applying the correct rate based on product taxability

- Handling rate changes and effective dates

- Managing origin-based sourcing for applicable states

Taxability of Digital Products: Digital products present special challenges:

- Different states tax digital products differently

- Some states tax all digital products

- Some exempt certain types of digital products

- Rules vary for software, music, videos, and other digital goods

- Sourcing rules for digital products can be complex

Shipping and Handling Taxability: Rules for taxing shipping and handling vary by state:

- Some states tax shipping if it's separately stated

- Some tax shipping only if the product is taxable

- Some exempt shipping regardless of product taxability

- Rules for handling charges vary similarly

Managing Exemptions for Online Sales: Online sellers must establish procedures for:

- Accepting exemption certificates online

- Verifying certificate validity

- Applying exemptions to appropriate purchases

- Maintaining records of exempt transactions

- Handling multi-state exemption certificates

International Sales Considerations: For businesses selling internationally:

- VAT/GST requirements for foreign countries

- Customs duties and import taxes

- Export exemption documentation

- Currency conversion considerations

- International tax treaties and agreements

Software Solutions for Multi-State Sales Tax

Given the complexity of multi-state sales tax compliance, many businesses turn to software solutions.

Types of Sales Tax Software: Several categories of solutions exist:

- Standalone sales tax calculators

- Integrated e-commerce solutions

- Enterprise tax automation platforms

- Accounting system integrations

- Managed service providers

Key Features to Look For: When evaluating sales tax software, consider:

- Accuracy of tax rate calculations

- Coverage of all necessary jurisdictions

- Integration with existing systems

- Automation of filing and remittance

- Reporting capabilities

- Exemption certificate management

- Audit support features

Popular Sales Tax Software Solutions: Several well-regarded options include:

- Avalara

- TaxJar

- Sovos

- Vertex

- Thomson Reuters ONESOURCE

- Intuit Sales Tax

Implementation Considerations: When implementing sales tax software:

- Data migration from existing systems

- Integration with e-commerce platforms

- Configuration of product taxability rules

- Setting up exemption certificate management

- Testing and validation processes

- Staff training requirements

Cost-Benefit Analysis: When evaluating software solutions, consider:

- Cost of software vs. cost of manual compliance

- Risk reduction from automated compliance

- Time savings for staff

- Scalability as the business grows

- Potential audit defense benefits

International Considerations

For businesses operating globally, international sales tax considerations add another layer of complexity.

Value-Added Tax (VAT) and Goods and Services Tax (GST): Most countries outside the U.S. use VAT or GST systems:

- Consumption taxes similar to sales tax

- Typically applied at multiple stages of production

- Often have credit mechanisms for businesses

- Rates vary by country and sometimes by region

- Often include international reclaim mechanisms

VAT/GST Registration Requirements: Businesses may need to register for VAT/GST in foreign countries when:

- Exceeding local sales thresholds

- Holding inventory in the country

- Having a physical presence

- Using local marketplaces or facilitators

Cross-Border E-Commerce Rules: Special rules often apply to cross-border online sales:

- Import VAT/GST on low-value goods

- Marketplace collection requirements

- Special schemes for digital services

- Country-specific exemptions and thresholds

Managing International Compliance: Strategies for handling international tax compliance include:

- Using global tax automation platforms

- Engaging local tax advisors

- Implementing specialized e-commerce solutions

- Establishing local entities in key markets

- Utilizing special schemes for small businesses

8. Industry-Specific Sales Tax Considerations

Restaurant and Food Service

The restaurant and food service industry faces unique sales tax challenges due to the complex rules surrounding food taxation.

Taxability of Food and Beverages: Food taxability varies significantly by state:

- Some states tax all prepared food

- Some exempt groceries but tax restaurant meals

- Some have reduced rates for food and beverages

- Some tax beverages differently from food

- Some distinguish between hot and cold prepared foods

Common Distinctions: States often make distinctions based on:

- Prepared vs. unprepared food

- On-premises vs. off-premises consumption

- Hot vs. cold prepared foods

- Alcoholic vs. non-alcoholic beverages

- Food sold with or without utensils

Special Rules for Restaurants: Restaurants must navigate:

- Split tax rates for food and alcohol

- Tax on service charges and automatic gratuities

- Takeout vs. dine-in tax differences

- Catering rules and exemptions

- Tax treatment of coupons and discounts

Bundled Transactions: Restaurants often deal with bundled transactions:

- Combo meals and value meals

- Party packages and event services

- Meal plans and subscriptions

- Gift card sales and redemption

- Loyalty programs and rewards

Industry-Specific Exemptions: Some states provide special exemptions for:

- Food sold by certain non-profit organizations

- School meals and educational institutions

- Hospital and healthcare facility food services

- Employee meals in certain circumstances

- Food samples and promotional items

Automotive Sales

The automotive industry has some of the most complex sales tax rules, with substantial financial implications.

Tax Basis for Vehicle Sales: Determining the taxable amount for vehicle sales involves:

- Negotiated price vs. sticker price

- Manufacturer rebates and incentives

- Dealer discounts and promotions

- Trade-in allowances

- Documentation and processing fees

Trade-In Allowances: Most states provide tax relief for trade-ins:

- Tax typically calculated on the net amount after trade-in

- Rules vary for private party vs. dealer trade-ins

- Some states have trade-in allowance caps

- Documentation requirements for trade-in transactions

- Special rules for leased vehicle trade-ins

Leasing vs. Purchasing: Different tax rules apply to vehicle leases:

- Tax typically calculated on monthly lease payments

- Some states tax the full value of the leased vehicle upfront

- Rules vary for early lease termination

- Tax treatment of lease-end purchase options

- Special considerations for business leases

Out-of-State Vehicle Purchases: Special rules apply when purchasing vehicles from other states:

- Credit for taxes paid to another state

- Use tax obligations in the home state

- Registration requirements and procedures

- Documentation for tax exemption or credit

- Special rules for military personnel

Industry-Specific Exemptions: Certain vehicle purchases may be exempt:

- Vehicles for certain government agencies

- Vehicles for non-profit organizations

- Vehicles used for specific agricultural purposes

- Vehicles adapted for disabled individuals

- Electric and alternative fuel vehicle incentives

Real Estate and Construction

The real estate and construction industries have specialized sales tax rules that differ significantly from general retail sales tax.

Taxability of Construction Services: Construction services are typically taxed differently from retail sales:

- Some states tax materials but not labor

- Some tax both materials and labor

- Some use a different tax structure for construction

- Rules vary for new construction vs. repairs

- Special rules for subcontractors and contractors

Lump Sum vs. Separated Contracts: How contracts are structured affects tax treatment:

- Lump sum contracts may have different tax implications

- Separated contracts for materials and labor

- Time and materials contracts

- Cost-plus contracts

- Design-build contracts

Real Property vs. Tangible Personal Property: Distinctions between property types affect taxability:

- Materials incorporated into real property

- Fixtures vs. equipment

- Capitalized maintenance vs. repairs

- Landscaping and hardscaping

- Specialized equipment installations

Contractor Tax Responsibilities: Contractors must navigate complex rules:

- Tax liability as a consumer or retailer

- Purchasing materials with resale certificates

- Tax obligations when working in multiple states

- Handling exemption certificates for exempt entities

- Special rules for government contracts

Industry-Specific Exemptions: Construction may have special exemptions for:

- Materials for certain government projects

- Energy-efficient construction materials

- Historic preservation projects

- Agricultural structures

- Affordable housing projects

Digital Products and Services

The taxation of digital products and services is one of the fastest-evolving areas of sales tax law.

Types of Digital Products: Digital products encompass a wide range of items:

- Software (downloaded, SaaS, cloud-based)

- Digital media (music, videos, books)

- Online courses and educational content

- Streaming services

- Digital subscriptions and memberships

- In-app purchases and virtual goods

- Online gaming and digital entertainment

Sourcing Rules for Digital Products: Determining where tax is due for digital products:

- Market-based sourcing for services

- Location of the customer

- Location of use

- Special rules for businesses vs. consumers

- International sourcing considerations

Taxability Variations by State: States take different approaches to digital products:

- Some tax all digital products the same as physical goods

- Some exempt certain categories of digital products

- Some have special rules for specific types of digital products

- Some tax digital services differently from digital goods

- Some have specific thresholds for digital product taxation

Marketplace Facilitator Implications: Digital products are often sold through marketplaces:

- App stores (Apple App Store, Google Play)

- Digital marketplaces (Amazon, Etsy)

- Streaming platforms (Netflix, Spotify)

- Online course platforms (Coursera, Udemy)

- Software marketplaces (Microsoft Store, Adobe Creative Cloud)

International Considerations: Digital products often cross international borders:

- VAT/GST obligations in foreign countries

- Special schemes for digital services (EU's VAT MOSS)

- Country-specific registration requirements

- Withholding tax implications

- Transfer pricing considerations for multinational businesses

Manufacturing and Wholesale

Manufacturing and wholesale businesses have specialized sales tax rules related to their production and distribution activities.

Manufacturing Exemptions: Most states provide exemptions for manufacturing:

- Raw materials and components

- Machinery and equipment

- Supplies used directly in production

- Utilities consumed in manufacturing

- Research and development equipment

Production vs. Administrative Use: Distinguishing between exempt and taxable use:

- Equipment used directly in production

- Equipment used for administrative purposes

- Dual-use equipment and allocation methods

- Supplies consumed in production vs. general operations

- Facility requirements for exemption qualification

Wholesale vs. Retail Sales: Different rules apply to different types of sales:

- Sales for resale with proper documentation

- Sales to exempt organizations

- Sales to other manufacturers

- Direct-to-consumer sales

- Mixed transactions with both wholesale and retail elements

Drop Shipping Arrangements: Special rules apply to drop shipping transactions:

- Tax responsibilities of the retailer

- Tax responsibilities of the supplier

- Exemption certificate requirements

- Multi-state considerations

- Nexus implications for all parties

Industry-Specific Compliance Challenges: Manufacturers and wholesalers face unique challenges:

- Complex exemption certificate management

- Multi-jurisdictional tax obligations

- Product taxability determination

- Use tax accrual on internal consumption

- Audit risk areas specific to manufacturing

9. Sales Tax Tools and Technology

Types of Sales Tax Calculators

Sales tax calculators come in various forms, each designed for specific use cases and levels of complexity.

Basic Online Calculators: Simple web-based tools for consumers and small businesses:

- Calculate tax on a single amount

- Support for state and local rates

- Limited jurisdiction coverage

- No integration capabilities

- Free or low-cost options available

Advanced Sales Tax Calculators: More sophisticated tools for businesses with greater needs:

- Support for multiple jurisdictions

- Product-specific taxability rules

- Exemption handling

- Date-specific rate calculations

- Reporting capabilities

- Subscription-based pricing

Point-of-Sale (POS) Integrated Calculators: Calculators built into POS systems:

- Real-time tax calculation during checkout

- Support for complex retail scenarios

- Integration with inventory management

- Multi-store capabilities

- Reporting and analytics features

E-commerce Platform Calculators: Calculators designed for online sales:

- Automatic calculation based on customer location

- Support for digital products and services

- Integration with shopping carts

- Handling of shipping taxability

- Marketplace facilitator integration

Mobile Sales Tax Calculators: Apps designed for mobile devices:

- On-the-go calculation capabilities

- Offline functionality

- GPS-based rate determination

- Camera-based receipt scanning

- Cloud synchronization

Sales Tax Software Comparison

When evaluating sales tax software solutions, businesses should consider several factors.

Market Leaders: Several companies dominate the sales tax software market:

- Avalara: Comprehensive solution with extensive features

- TaxJar: User-friendly interface focused on e-commerce

- Sovos: Strong compliance and reporting capabilities

- Vertex: Enterprise-level solution with robust features

- Thomson Reuters ONESOURCE: Full-suite tax management

Feature Comparison: Key features to evaluate include:

- Tax rate accuracy and coverage

- Product taxability rules

- Exemption certificate management

- Filing and remittance automation

- Reporting capabilities

- Integration options

- Audit support features

- International tax capabilities

Pricing Models: Sales tax software pricing varies significantly:

- Transaction-based pricing (per transaction or per document)

- Tiered pricing based on sales volume

- Module-based pricing for specific features

- Enterprise pricing for large organizations

- Custom pricing for complex needs

Implementation Considerations: When implementing sales tax software:

- Data migration requirements

- System integration needs

- Configuration and customization

- Testing and validation

- Staff training requirements

- Ongoing maintenance and updates

Scalability: Consider how the software will grow with your business:

- Ability to add new jurisdictions

- Handling increased transaction volume

- Supporting new business lines

- Accommodating organizational growth

- Adapting to changing tax laws

Automated Sales Tax Solutions

Automation has become increasingly important for managing sales tax compliance efficiently.

Benefits of Automation: Automated solutions offer numerous advantages:

- Reduced risk of errors

- Time savings for staff

- Improved compliance

- Better audit preparation

- Real-time tax calculations

- Scalability for growth

Key Automation Features: Look for these automation capabilities:

- Automatic rate updates

- Product taxability determination

- Exemption certificate validation

- Return preparation and filing

- Payment processing

- Reporting and analytics

Integration Capabilities: Seamless integration with existing systems is crucial:

- E-commerce platforms

- Point-of-sale systems

- Accounting software

- ERP systems

- Inventory management

- CRM systems

Cloud-Based Solutions: Cloud technology offers specific advantages:

- No hardware requirements

- Automatic updates

- Accessibility from anywhere

- Subscription pricing models

- Scalability

- Integration with other cloud services

Implementation Best Practices: When implementing automated solutions:

- Conduct thorough needs assessment

- Map existing processes

- Plan data migration carefully

- Test extensively before go-live

- Provide comprehensive training

- Establish ongoing maintenance procedures

Integrating Sales Tax Tools with POS Systems

Integration between sales tax tools and POS systems is essential for accurate tax collection at the point of sale.

Integration Approaches: Several methods exist for integrating sales tax tools:

- Direct integration with POS software

- Middleware solutions

- API-based integrations

- Standalone calculators with manual entry

- Hybrid approaches combining methods

Common POS Integrations: Sales tax tools often integrate with popular POS systems:

- Square

- Shopify POS

- Lightspeed

- Toast (restaurant industry)

- Clover

- QuickBooks Point of Sale

- Retail Pro

Integration Benefits: POS integration offers numerous advantages:

- Real-time tax calculation

- Reduced cashier errors

- Consistent tax application

- Simplified reporting

- Better customer experience

- Enhanced audit trail

Implementation Challenges: Businesses may face challenges during integration:

- Compatibility issues with older POS systems

- Data synchronization problems

- Customization requirements

- Testing and validation complexity

- Staff training needs

- Ongoing maintenance requirements

Best Practices for POS Integration: To ensure successful integration:

- Conduct thorough compatibility testing

- Map all product taxability rules

- Test various transaction scenarios

- Implement exception handling procedures

- Document integration processes

- Establish monitoring and maintenance procedures

Future of Sales Tax Technology

The sales tax technology landscape continues to evolve rapidly.

Emerging Technologies: Several technologies are shaping the future of sales tax compliance:

- Artificial intelligence for taxability determination

- Machine learning for audit risk assessment

- Blockchain for tax record-keeping

- Advanced analytics for tax optimization

- Cloud-native solutions for scalability

- Mobile-first design approaches

Trends in Sales Tax Technology: Key trends include:

- Increased automation

- Greater integration capabilities

- Enhanced user experiences

- Expanded international support

- Improved reporting and analytics

- More affordable solutions for small businesses

Regulatory Technology (RegTech): The intersection of regulation and technology is growing:

- Automated regulatory updates

- Compliance monitoring

- Risk assessment tools

- Audit preparation assistance

- Regulatory reporting automation

Impact of Wayfair on Technology: The Wayfair decision has significantly influenced technology development:

- Increased demand for multi-state solutions

- Enhanced economic nexus tracking

- Improved state registration workflows

- Better marketplace facilitator support

- More sophisticated rate calculation engines

Future Predictions: Looking ahead, we can expect:

- Greater standardization of tax rules

- Increased government adoption of technology

- More sophisticated AI applications

- Enhanced real-time reporting capabilities

- Improved cross-border tax solutions

- Greater emphasis on user experience

10. Sales Tax Audits and Compliance

Preparing for a Sales Tax Audit

A sales tax audit can be a stressful experience for any business, but proper preparation can significantly reduce the anxiety and potential negative outcomes.

Understanding the Audit Process: Sales tax audits typically follow a standard process:

- Notification: The business receives an audit notice

- Initial meeting: The auditor explains the process and scope

- Records request: The auditor requests specific documentation

- Examination: The auditor reviews records and transactions

- Preliminary findings: The auditor shares initial results

- Discussion: The business can respond to preliminary findings

- Final report: The auditor issues the final audit report

- Resolution: The business either agrees or appeals the findings

Pre-Audit Preparation: Proactive preparation can make the audit process smoother:

- Conduct a self-audit before the official audit

- Review and organize all sales tax records

- Ensure exemption certificates are complete and valid

- Verify that tax returns were filed accurately and on time

- Document any unusual transactions or exemptions

- Prepare staff for potential interviews

Record Organization: Proper record organization is essential:

- Organize records by audit period

- Separate sales and purchase records

- Prepare exemption certificates for review

- Organize returns and payment documentation

- Prepare general ledger and financial statements

- Create indexes or summaries of large volumes of records

Staff Preparation: Ensure staff members are ready for the audit:

- Designate a primary point of contact for the auditor

- Prepare staff who may be interviewed

- Review key processes and procedures

- Ensure everyone understands the importance of accurate responses

- Establish protocols for communicating with the auditor

Professional Representation: Consider engaging professional help:

- Sales tax consultants or attorneys

- CPAs with sales tax expertise

- Audit defense services

- Industry-specific specialists

Common Audit Triggers

Understanding what triggers sales tax audits can help businesses avoid scrutiny.

Filing and Payment Issues: Several filing and payment patterns may trigger audits:

- Consistently late filings

- Frequent amendments to returns

- Large refund claims

- Inconsistent reporting patterns

- Significant changes in reported tax

- Mathematical errors on returns

Industry and Business Factors: Certain industries and business characteristics attract attention:

- Cash-intensive businesses

- Businesses with complex exemption usage

- Industries known for high non-compliance rates

- Businesses with significant drop-shipping activities

- Companies with recent ownership changes

- Businesses in high-tax industries (alcohol, tobacco, etc.)

Excessive Exemptions: Exemption usage can raise red flags:

- High percentage of exempt sales

- Incomplete or invalid exemption certificates

- Exemption certificates from out-of-state customers

- Frequent changes in exemption patterns

- Large-dollar exemption transactions

Nexus and Registration Issues: Problems with business registration may trigger audits:

- Late registration for sales tax permits

- Operating in multiple states without proper registration

- Changes in business structure without updating registrations

- Inconsistent business information across jurisdictions

- Marketplace facilitator reporting discrepancies

Information Matching: States use various matching techniques:

- Third-party reporting (1099-K, etc.)

- Income tax return comparisons

- Business license databases

- Public records and business directories

- Information sharing between states

What to Expect During an Audit

Understanding the audit process can help businesses prepare and respond appropriately.

Audit Notification: The audit typically begins with:

- Written notice of the audit

- Information about the audit period

- Request for an initial meeting

- List of records to prepare

- Contact information for the auditor

Initial Meeting: The first meeting usually covers:

- Introduction of the auditor

- Explanation of the audit process

- Discussion of the audit scope

- Review of the business operations

- Schedule for the audit examination

- Procedures for requesting information

Records Examination: The auditor will review various records:

- Sales invoices and receipts

- Purchase records and invoices

- Exemption certificates

- General ledger and financial statements

- Sales tax returns and payments

- Bank statements and deposit records

Sampling Methods: Auditors often use sampling techniques:

- Random sampling of transactions

- Stratified sampling based on transaction size

- Block sampling of specific time periods

- Judgmental sampling of high-risk areas

- Statistical sampling for large populations

Employee Interviews: Auditors may interview staff members:

- Owners and managers

- Accounting personnel

- Sales staff

- Purchasing personnel

- IT staff responsible for systems

Preliminary Findings: Before finalizing the audit, the auditor will:

- Share initial findings with the business

- Provide explanations for any discrepancies

- Allow the business to respond to findings

- Consider additional documentation or explanations

- Discuss potential adjustments

Responding to Audit Findings

How a business responds to audit findings can significantly impact the final outcome.

Reviewing the Audit Report: Carefully examine the final audit report:

- Verify all calculations and figures

- Understand the basis for each adjustment

- Identify any factual errors

- Note any legal or regulatory misinterpretations

- Assess the total financial impact

Negotiating with the Auditor: Professional negotiation may resolve some issues:

- Present additional documentation

- Explain complex transactions

- Clarify misunderstandings

- Propose reasonable compromises

- Request penalty abatement where appropriate

Formal Appeals Process: If agreement cannot be reached:

- File a formal appeal according to state procedures

- Prepare a detailed written response

- Gather supporting documentation

- Consider professional representation

- Be prepared for a hearing or further review

Payment Options: If the audit results in additional tax due:

- Pay the full amount immediately

- Request a payment plan

- Explore penalty abatement options

- Consider interest reduction possibilities

- Verify all calculations before payment

Post-Audit Compliance: Use the audit experience to improve future compliance:

- Implement recommended changes

- Update procedures and documentation

- Enhance staff training

- Consider automation or software solutions

- Establish ongoing monitoring procedures

Best Practices for Maintaining Compliance

Proactive compliance measures can reduce audit risk and ensure ongoing accuracy.

Regular Internal Reviews: Conduct periodic self-audits:

- Review exemption certificates for validity

- Verify tax calculations on sample transactions

- Check filing accuracy and timeliness

- Assess nexus in all operating states

- Evaluate system configurations for accuracy

Documentation Standards: Maintain thorough documentation:

- Keep detailed records of all transactions

- Maintain complete exemption certificates

- Document taxability decisions

- Record system changes and updates

- File all returns and payment confirmations

Staff Training: Ensure staff understand compliance requirements:

- Regular training on sales tax basics

- Updates on law and regulation changes

- Procedures for handling exemptions

- System use and troubleshooting

- Documentation requirements

System Controls: Implement controls in your systems:

- Regular system audits and reviews

- User access controls and approvals

- Automated checks for unusual transactions

- System-generated exception reports

- Regular updates for tax rate changes

Professional Guidance: Consider ongoing professional support:

- Regular consultations with tax advisors

- Membership in industry associations

- Subscription to tax research services

- Participation in tax seminars and webinars

- Relationships with state tax authorities

11. Sales Tax Strategies and Planning

Legal Ways to Minimize Sales Tax Burden

While sales tax is generally unavoidable, there are legal strategies to minimize its impact on both individuals and businesses.

For Consumers: Individuals can reduce their sales tax burden through:

- Shopping during sales tax holidays

- Making purchases in low-tax jurisdictions when practical

- Taking advantage of exemptions for specific items

- Bundling purchases to qualify for exemptions

- Using resale certificates when appropriate

- Planning large purchases strategically

For Businesses: Businesses have more opportunities to legally minimize sales tax:

- Properly documenting exempt sales

- Structuring transactions to take advantage of exemptions

- Carefully managing nexus to avoid unnecessary registration

- Using drop-shipping arrangements effectively

- Taking advantage of available credits and incentives

- Implementing systems to ensure accurate tax collection

Exemption Certificate Management: Proper exemption certificate handling can significantly reduce tax burden:

- Establishing robust procedures for collecting certificates

- Regularly reviewing and updating certificates

- Verifying certificate validity before applying exemptions

- Maintaining organized records for audit defense

- Training staff on proper certificate handling

Entity Structure Planning: Business structure can affect sales tax obligations:

- Separating taxable and non-taxable business lines

- Structuring multi-state operations efficiently

- Considering holding company structures

- Evaluating the impact of different entity types

- Planning for business expansions and contractions

Transaction Structuring: How transactions are structured can affect tax treatment:

- Separating taxable and non-taxable components

- Properly handling bundled transactions

- Considering lease vs. purchase options

- Evaluating the tax impact of different pricing strategies

- Structuring service agreements efficiently

Strategic Pricing with Sales Tax in Mind

Sales tax considerations should factor into pricing strategies for businesses.

Tax-Inclusive vs. Tax-Exclusive Pricing: Businesses must decide how to present prices:

- Tax-exclusive pricing (common in the U.S.)

- Tax-inclusive pricing (common in many other countries)

- Hybrid approaches for different markets

- Industry-specific conventions

- Customer perception considerations

Psychological Pricing Strategies: Sales tax affects psychological pricing points:

- Adjusting prices to account for tax rounding

- Setting prices to land on appealing after-tax amounts

- Considering the impact of tax on perceived value

- Evaluating price points across different tax jurisdictions

- Managing customer expectations regarding final price

Multi-Jurisdictional Pricing: Businesses operating in multiple tax jurisdictions face additional challenges:

- Consistent pricing across different tax rates

- Zone pricing to account for tax variations

- Geographic pricing strategies

- Managing price transparency with different tax rates

- Communicating tax-inclusive vs. tax-exclusive prices

Promotional Pricing Considerations: Sales tax affects promotional strategies:

- Calculating the true impact of percentage discounts

- Structuring buy-one-get-one-free offers

- Handling coupon and discount redemption

- Evaluating the tax impact of loyalty programs

- Designing effective sales tax holiday promotions

Competitive Pricing Analysis: Sales tax must be considered in competitive analysis:

- Comparing after-tax prices with competitors

- Evaluating cross-border competitive advantages

- Assessing the impact of online vs. in-person competition

- Considering marketplace facilitator pricing effects

- Analyzing the impact of tax differences on market share

Timing Purchases Around Sales Tax Holidays

Sales tax holidays provide opportunities for significant savings on certain purchases.

Understanding Sales Tax Holidays: Sales tax holidays are temporary periods when specific items can be purchased tax-free:

- Typically occur before back-to-school season

- Often have price thresholds for eligible items

- May include specific product categories

- Vary significantly by state

- Have specific start and end times

Common Sales Tax Holiday Categories: Most states focus on similar categories during tax holidays:

- Clothing and footwear (typically under $100 per item)

- School supplies (often with price limits)

- Computers and computer accessories (with higher thresholds)

- Energy-efficient appliances

- Emergency preparedness supplies

- Hurricane preparedness items (in coastal states)

Planning for Sales Tax Holidays: Consumers can maximize savings by planning ahead:

- Researching eligible items and price limits

- Comparing prices across retailers

- Making lists of needed purchases

- Budgeting for larger purchases

- Understanding specific rules and restrictions

Business Strategies for Sales Tax Holidays: Retailers can leverage tax holidays to boost sales:

- Promoting eligible items in advance

- Stocking appropriate inventory

- Training staff on holiday rules

- Implementing system changes for tax-free processing

- Creating special promotions and events

Maximizing Savings: Strategies to get the most from tax holidays:

- Combining tax holiday savings with other discounts

- Timing large purchases to coincide with holidays

- Splitting purchases to stay within price limits

- Understanding layaway and raincheck policies

- Considering online vs. in-person purchasing options

Structuring Transactions for Tax Efficiency

How transactions are structured can have significant tax implications.

Separating Taxable and Non-Taxable Components: In transactions with mixed taxability:

- Separately stating taxable and non-taxable items

- Properly documenting bundled services

- Handling mixed-use property appropriately

- Allocating costs for partially exempt transactions

- Maintaining clear records for tax purposes

Lease vs. Purchase Decisions: The choice between leasing and purchasing affects tax treatment:

- Different tax treatment for leases vs. purchases

- Sales tax implications of capital leases vs. operating leases

- Tax treatment of lease-end purchase options

- Considerations for equipment financing

- Long-term tax planning for major acquisitions

Drop Shipping Strategies: Drop shipping arrangements require careful structuring:

- Understanding the tax responsibilities of each party

- Proper exemption certificate handling

- Managing multi-state tax obligations

- Documenting transactions for audit purposes

- Evaluating the tax impact of different drop-shipping models

Intercompany Transactions: Transactions between related entities require special attention:

- Transfer pricing considerations

- Documentation requirements for related-party transactions

- Tax treatment of services between entities

- Handling inventory transfers

- Managing cost allocation for shared services

Contract Negotiation: Sales tax considerations should be part of contract negotiations:

- Specifying tax responsibility in agreements

- Addressing tax rate changes in long-term contracts

- Handling exemption certificates in contractual relationships

- Dealing with tax indemnification clauses

- Planning for audit contingencies in contracts

Long-Term Sales Tax Planning for Businesses

Strategic long-term planning can help businesses manage their sales tax obligations effectively.

Nexus Planning: Proactive nexus management is essential:

- Regularly reviewing nexus triggers

- Planning business expansions with tax in mind

- Evaluating the tax impact of different growth strategies

- Considering the benefits of remote work policies

- Managing the tax implications of economic nexus thresholds

System Selection and Implementation: Choosing the right systems is crucial for long-term compliance:

- Evaluating scalability of current systems

- Planning for future business complexity

- Considering integration capabilities

- Assessing total cost of ownership

- Planning for system updates and replacements

Staff Training and Development: Investing in staff knowledge pays long-term dividends:

- Regular training on sales tax basics

- Keeping staff updated on law changes

- Developing in-house expertise

- Cross-training for redundancy

- Creating documentation for institutional knowledge

Compliance Calendar Management: Maintaining a comprehensive compliance calendar helps avoid missed deadlines:

- Tracking filing due dates for all jurisdictions

- Planning for rate changes and effective dates

- Scheduling regular internal reviews

- Planning for system updates and maintenance

- Coordinating with external advisors and service providers

Audit Preparation and Defense: Ongoing preparation reduces audit risk and impact:

- Maintaining organized records

- Documenting tax positions and decisions

- Conducting regular self-audits

- Staying current on enforcement trends

- Developing relationships with tax authorities

12. International Sales Tax Considerations

Sales Tax vs. VAT/GST

The United States is somewhat unique in its use of sales tax rather than a Value-Added Tax (VAT) or Goods and Services Tax (GST) system.

Fundamental Differences: The primary distinctions between sales tax and VAT/GST systems include:

- Point of collection: Sales tax is collected at the final sale to the consumer, while VAT/GST is collected at each stage of production and distribution

- Credit mechanism: VAT/GST includes a credit system for businesses to reclaim tax paid on inputs, while sales tax typically does not

- Tax base: VAT/GST generally has a broader tax base than sales tax

- Rate structure: VAT/GST typically has fewer rate variations than sales tax

VAT/GST Mechanics: Understanding how VAT/GST works is important for international business:

- Tax is collected at each stage of production and distribution

- Businesses can claim credits for VAT/GST paid on business inputs

- The ultimate economic burden falls on the final consumer

- Rates are generally uniform across regions within a country