Sales Tax Calculator

Instantly calculate sales tax with our free and easy-to-use calculator. Our comprehensive guide covers everything you need to know about sales tax in the US.

Result

| Net Amount | ||

|---|---|---|

| Tax Rate | ||

| Gross Amount |

Share on Social Media:

The Ultimate Sales Tax Calculator & Guide

Calculating sales tax can be a headache, whether you're a shopper trying to figure out the final price of a purchase or a business owner trying to stay compliant. Miscalculations can lead to overpaying or, even worse, underpaying and facing penalties.

This is where our Sales Tax Calculator comes in. But we're not just giving you a tool; we're giving you the ultimate guide to understanding and mastering sales tax in the United States.

How to Use Our Sales Tax Calculator

Our sales tax calculator is designed to be simple and intuitive. Here's a step-by-step guide:

Enter the Purchase Price: In the "Amount" field, enter the pre-tax price of the item or service.

Enter the Sales Tax Rate: In the "Tax Rate (%)" field, enter the sales tax rate for your location. If you're not sure what it is, don't worry! We have a comprehensive guide below.

Click "Calculate": The calculator will instantly show you the sales tax amount and the total price of the purchase.

Pro-Tip: You can also use our calculator in reverse! If you know the total price and the sales tax rate, you can calculate the original price of the item.

What is Sales Tax? A Simple Explanation

Sales tax is a consumption tax imposed by state and local governments on the sale of goods and services. When you buy a product at a retail store, the sales tax is added to the price of the item at the point of sale. The retailer then collects this tax and remits it to the government.

The Difference Between Sales Tax, Use Tax, and Excise Tax

Sales Tax: A tax on the sale of goods and services.

Use Tax: A tax on the use, storage, or consumption of goods or services when sales tax has not been paid. This often applies to items purchased online or out-of-state.

Excise Tax: A tax on a specific type of good, such as gasoline, tobacco, or alcohol.

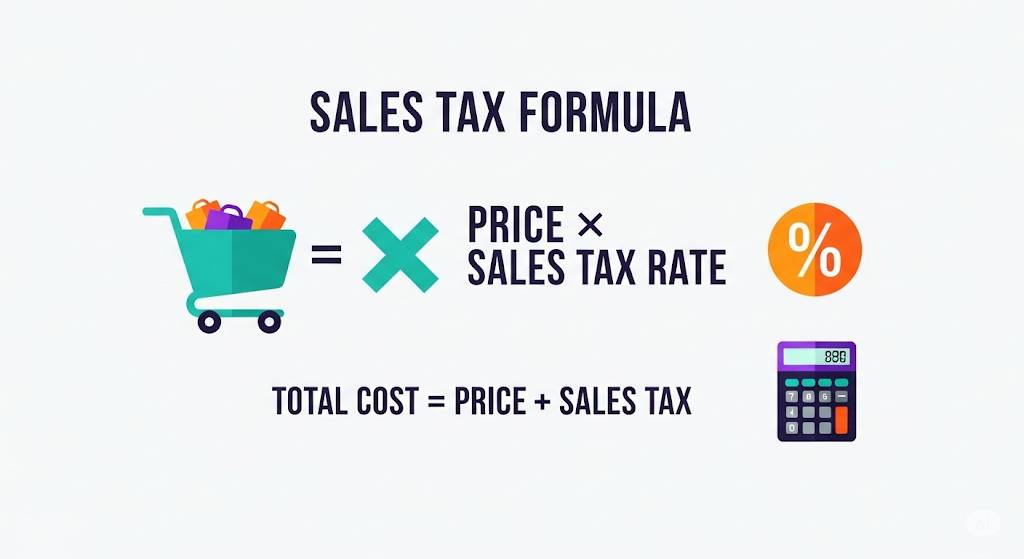

How to Calculate Sales Tax: The Formula

The formula for calculating sales tax is simple:

Sales Tax = Purchase Price x Sales Tax Rate

Total Price = Purchase Price + Sales Tax

Example:

Let's say you're buying a new laptop for $1,000 in a city with a sales tax rate of 8%.

Sales Tax: $1,000 x 0.08 = $80

Total Price: $1,000 + $80 = $1,080

State-by-State Sales Tax Guide

Sales tax rates vary significantly from state to state, and even from city to city. Here's a breakdown of sales tax rates across the United States.

Sales Tax for Online Businesses

The rules for collecting sales tax for online businesses have changed significantly in recent years. The 2018 Supreme Court case South Dakota v. Wayfair ruled that states can charge tax on purchases made from out-of-state sellers, even if the seller does not have a physical presence in the taxing state.

This concept is known as economic nexus. Each state has its own threshold for economic nexus, which is usually based on the seller's sales revenue or number of transactions in that state.

Sales Tax on Shipping and Handling

Whether or not sales tax is charged on shipping and handling fees depends on the state.

Some states consider shipping and handling to be part of the total sale price and therefore taxable.

Other states consider shipping and handling to be a separate service and therefore not taxable.

It's crucial to check the rules for each state where you do business.

Sales Tax Exemptions

Not all goods and services are subject to sales tax. Common exemptions include:

Groceries: Most states exempt unprepared food items from sales tax.

Prescription Drugs: Prescription medications are typically exempt from sales tax.

Sales to Non-Profits: Sales to registered non-profit organizations are often exempt.

How to Get a Sales Tax Exemption Certificate

If your business qualifies for sales tax exemptions, you'll need to obtain a sales tax exemption certificate from your state's department of revenue. This certificate allows you to purchase items for resale or for use in your business without paying sales tax.

What Happens if You Don't Pay Sales Tax?

Failing to collect and remit sales tax can have serious consequences for a business, including:

Penalties and Fines: States can impose hefty penalties and fines for non-compliance.

Back Taxes: You may be required to pay back taxes, plus interest.

Legal Action: In severe cases, the state may take legal action against your business.

Understanding Sales Tax and Its Importance

As a professional in finance and commerce, I recognize the critical role that sales tax plays in the economic structure of jurisdictions. It is a pivotal source of revenue that supports public services and infrastructure. I leverage a Sales Tax Calculator for precise tax computation to ensure that every invoice reflects the correct percentage owed. This tool is indispensable for upholding the integrity of financial transactions and maintaining the trust of my customers.

Streamlining compliance with jurisdiction-specific tax laws is no easy feat, yet it is necessary to avoid costly errors that could arise from manual calculations. An efficient Sales Tax Calculator is a valuable asset in my arsenal, ensuring I adhere to the intricate web of tax regulations. By accurately calculating sales tax on every purchase, I enhance customer trust and fortify the credibility of my business.

Key Features of an Efficient Sales Tax Calculator

An Efficient Sales Tax Calculator is a cornerstone for precise tax computation. It is designed to align with jurisdiction-specific percentage rates, ensuring full compliance with tax laws. This tool is a game-changer, as it streamlines purchase invoicing by automatically integrating sales tax calculations, thereby reducing errors and maintaining the high standard of compliance that my business is known for.

Moreover, with jurisdictional updates, the Sales Tax Calculator I employ guarantees current compliance, minimizing audit risks and enhancing transaction accuracy. This dynamic adaptability is crucial in a landscape where tax regulations can change with legislative shifts, ensuring that my business remains on the right side of the law.

Streamlining Tax Computation with Advanced Tools

I leverage a Sales Tax Calculator to ensure accurate tax computation and reduce human error in percentage calculations per invoice. This advanced tool is instrumental in maintaining seamless compliance with varying jurisdiction sales tax laws during every purchase. By streamlining the tax computation process with this sophisticated calculator, I enhance efficiency in managing sales tax across multiple jurisdictions. This task would otherwise be daunting and fraught with potential inaccuracies.

The Role of Percentages in Sales Tax Calculation

Understanding and applying the correct percentages in sales tax calculation is crucial for compliance. Utilizing a Sales Tax Calculator ensures that the tax computation is accurate and reflects the specific percentage mandated by each jurisdiction. This streamlines purchase invoicing and facilitates compliance with local and state tax regulations. Implementing an efficient Sales Tax Calculator in my business operations minimizes errors in tax application on sales transactions, which is essential for guaranteeing jurisdictional compliance and maintaining the financial integrity of my business.

Navigating Complex Jurisdictional Tax Rules

The complexity of jurisdictional tax rules presents a significant challenge for businesses. To navigate this complexity, I leverage a Sales Tax Calculator to ensure precise tax computation, adhering to the varying percentage rates across jurisdictions. This tool is indispensable for streamlining purchase invoice processing and guaranteeing compliance with complex jurisdictional tax laws. By optimizing tax accuracy on each transaction, the calculator I utilize dynamically adjusts to jurisdiction-specific sales tax regulations, which is vital for the precise application of sales taxes.

Automated Calculators for Accurate Purchase Invoicing

In my practice, I have found that leveraging an Automated Sales Tax Calculator ensures precise tax computation and adherence to jurisdiction-specific tax percentages. This automation streamlines purchase invoicing, minimizing errors and enhancing compliance with ever-changing tax regulations. Incorporating an efficient Sales Tax Calculator to automate tax calculations on invoices is a strategic move that ensures accuracy and jurisdictional tax compliance, which is critical for the smooth operation of my business.

Integrating Sales Tax Calculators with POS Systems

Integrating a Sales Tax Calculator with POS systems is a transformative step towards achieving precision in tax computation and ensuring compliance with varying jurisdictional tax percentages. This integration streamlines the purchase process, reducing invoice errors and enhancing efficiency. By leveraging a Sales Tax Calculator within POS systems, I can automatically adjust to jurisdiction-specific tax laws in real time, which is invaluable for the fast-paced environment where my business operates.

Ensuring Compliance with State and Local Tax Laws

To ensure compliance with state and local tax laws, I leverage a Sales Tax Calculator that accurately reflects the correct percentage per jurisdiction on every invoice. This tool is essential for streamlining purchase processes and guaranteeing compliance with varying tax laws. By enhancing fiscal responsibility, my calculator automatically updates the latest tax rates, providing reliable jurisdiction compliance and peace of mind.

The Impact of Sales Tax on Consumer Pricing

In the consumer market, pricing transparency is critical. Utilizing a Sales Tax Calculator ensures accurate tax computation, reflecting the correct percentage on consumer invoices. This precise calculation aids my business in adhering to varying jurisdiction tax laws, ensuring compliance with minimal effort. Furthermore, incorporating an efficient Sales Tax Calculator minimizes errors, ensuring that consumers are charged the appropriate tax on each purchase, which is crucial for maintaining consumer trust and satisfaction.

Customizable Sales Tax Solutions for Businesses

The Sales Tax Calculator I use ensures accurate tax computation, adjusting the percentage to comply with specific jurisdiction requirements. This customization streamlines my invoice process, embedding sales tax calculations for seamless purchase transactions and compliance. I maintain compliance across various jurisdictions by leveraging our customizable Sales Tax Calculator, enhancing my business efficiency and accuracy.

Real-Time Calculation for Faster Checkout Processes

Integrating a Sales Tax Calculator in my checkout processes ensures accurate tax computation, streamlining transactions for faster customer service. The calculator adjusts the sales tax percentage in real time, maintaining compliance with varying jurisdiction tax laws on every purchase. Automated invoice generation with precise sales tax calculations minimizes errors and enhances efficiency during the checkout phase, which is crucial for providing a smooth customer experience.

Simplifying the Tax Collection Process for Retailers

To simplify the tax collection process, I integrate a Sales Tax Calculator that ensures accurate tax computation, reflecting the correct percentage on every purchase invoice. Utilizing this tool, I maintain compliance with varying jurisdictional tax laws, simplifying my financial operations. Adopting an advanced Sales Tax Calculator streamlines the calculation process, reducing errors and improving efficiency in sales transactions, which is essential for the smooth operation of my retail business.

Addressing Multi-State Sales Tax Challenges

An efficient Sales Tax Calculator is vital for addressing the challenges of multi-state sales tax. It ensures accurate tax computation, reducing errors on invoices across multiple jurisdictions. The calculator streamlines compliance by automatically adjusting the percentage rate based on the purchase location. This simplification is invaluable for my business, ensuring that each invoice reflects the correct tax obligations, no matter where the transaction occurs.

Enhancing Reporting Capabilities for Tax Audits

For tax audits, accuracy is paramount. Integrating a Sales Tax Calculator ensures precise tax computation, enhancing the accuracy of every purchase invoice. By utilizing this tool, I guarantee compliance with varying jurisdiction percentage rates during tax audits. The Sales Tax Calculator streamlines audit reporting, providing precise, jurisdiction-specific calculations on each invoice, which is critical for auditors and for upholding the financial integrity of my business.

The Benefits of Cloud-Based Sales Tax Calculators

Cloud-based Sales Tax Calculators offer numerous benefits. They streamline tax computation, ensuring accurate percentage calculations for each jurisdiction on every invoice. These tools enhance compliance with efficient adaptation to diverse jurisdiction requirements during purchase processes. Moreover, they reduce invoice errors, delivering jurisdiction-specific tax rates for reliable purchase transactions, which is essential for the smooth operation of my business in the digital age.

User-Friendly Interfaces for Non-Tax Experts

The Sales Tax Calculator I use is designed intuitively, ensuring accurate tax computation for every purchase and fostering jurisdiction compliance. Incorporating jurisdiction-specific percentage rates into the calculator streamlines invoice processing for seamless sales tax calculations. The user-friendly interface enables non-experts like myself to achieve compliance with minimal effort, which is invaluable for businesses without dedicated tax professionals.

Calculating Sales Tax for Online Transactions

For online transactions, calculating sales tax accurately is crucial. I utilize a Sales Tax Calculator to ensure accurate tax computation, reflecting the correct percentage for each jurisdiction. This tool streamlines invoice processing by automating purchase-related tax calculations for compliance. By leveraging a Sales Tax Calculator, I maintain jurisdiction compliance, minimizing errors in sales tax reporting for online transactions, which is essential in an increasingly digital marketplace.

Keeping Up with Changing Tax Legislation

To keep up with changing tax legislation, I leverage a Sales Tax Calculator that ensures accurate tax computation, reflecting current percentage rates across various jurisdictions. This tool streamlines invoice processing and guarantees compliance with the latest tax legislation changes. By utilizing a Sales Tax Calculator, I enhance purchase transactions with precise jurisdiction-specific tax calculations and compliance, ensuring that my business adapts swiftly to legislative updates.

Improving Accuracy with Automated Tax Updates

Accuracy in tax computation is non-negotiable. The Sales Tax Calculator I use automatically updates percentages for jurisdiction compliance, ensuring precise tax computation. This automation streamlines invoice processing, reducing errors in purchase calculations for multi-jurisdictional compliance. By optimizing sales tax accuracy, the calculator is designed for seamless integration of automated tax updates, meeting compliance standards, and maintaining the financial integrity of my business.

Reducing Errors and Avoiding Penalties

To minimize invoice errors and avoid compliance penalties, I utilize a Sales Tax Calculator that ensures accurate tax computation. This tool allows me to adjust for varying jurisdiction percentages, maintaining precise purchase tax calculations. By leveraging a Sales Tax Calculator, I streamline the sales process, reducing the risk of jurisdiction non-compliance and associated fines, which is crucial for my business's fiscal responsibility and reputation.

Frequently Asked Questions (FAQ)

1. How is sales tax calculated on a car?

Sales tax on a car is typically calculated based on the purchase price of the vehicle. However, some states may have different rules, so it's best to check with your local DMV.

2. Do you pay sales tax on used items?

In most cases, yes. Sales tax is generally charged on the sale of tangible personal property, whether it's new or used.

3. Is there a federal sales tax?

No, the United States does not have a federal sales tax. Sales taxes are imposed at the state and local levels.

4. What is a sales tax holiday?

A sales tax holiday is a period of time when certain items can be purchased without paying sales tax. These holidays are often held in the back-to-school season.

5. How often do I need to file sales tax returns?

The frequency of sales tax filing depends on your sales volume and the state where you're registered. It can be monthly, quarterly, or annually.

Conclusion

Understanding and calculating sales tax is a critical skill for both consumers and business owners. With our Sales Tax Calculator and this comprehensive guide, you have everything you need to navigate the complex world of sales tax with confidence.

Author Bio:

Written by Sohel Rana, CPA: Sohel Rana is a Certified Public Accountant with over 15 years of experience in tax planning and compliance for small businesses and e-commerce entrepreneurs. He is the author of the best-selling book, "Sales Tax Demystified," and has been featured in Forbes and Business Insider.